Blog

Investing 101

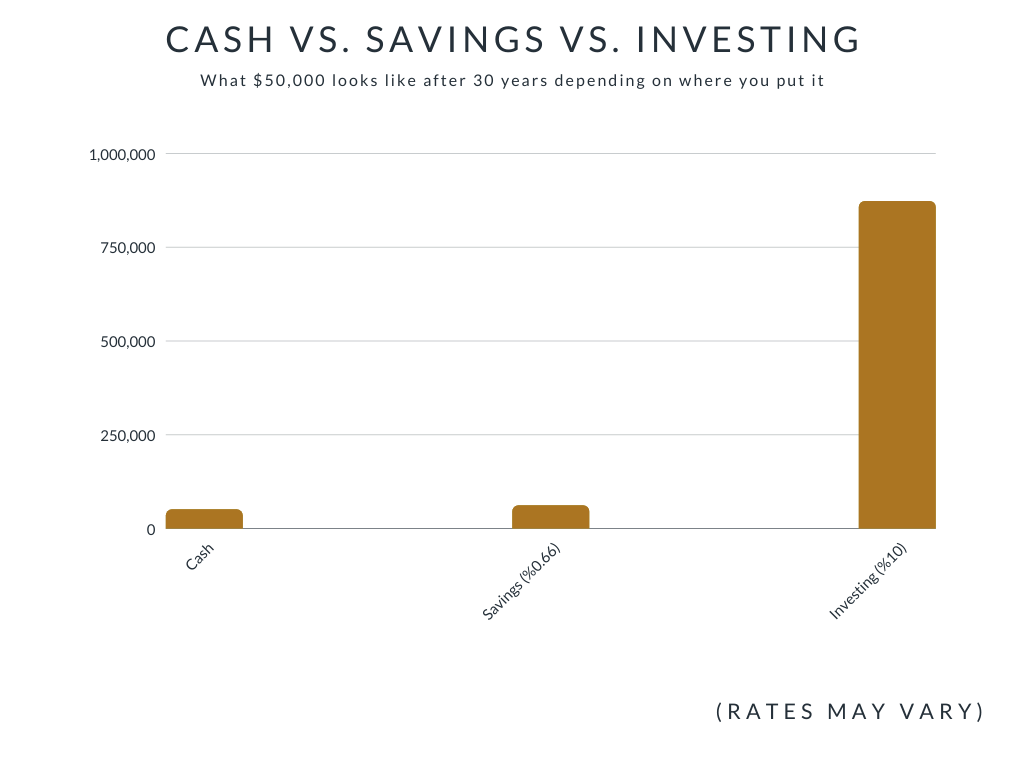

It is not enough to simply save for retirement. You need to put your money to work. Investing that money will help it grow and compound at a much faster rate, allowing you to retire much more comfortably.

There are a few things to consider

Do you have a rainy day fund?

You never know when things will get ugly. You could lose your job, lose your home, become ill, or maybe live through another pandemic. It is best to be prepared for these situations financially. Typically it is best to save around 6 months to a years worth of living expenses just in case.

Do you have bad debt?

Some debt is okay, for instance a home mortgage. However too much consumer debt, for example credit card debt is never good. That 14-24% of interest can really take a large portion of your money, so it is best to pay off your bad debt before you really begin investing.

What to invest in?

There are many things you can invest in including stocks, bonds, ETF’s, real estate and more. The stock market is proven to provide a great long-term return on your investment.

Individual Stocks

A piece of company that anyone can buy. Stocks can move up and down depending on many factors, therefor you can make a lot of money, but also lose a lot.

Bonds

A loan with interest. Interest rates are normally higher than that of banks, so you are taking on slightly more risk.

Real estate

Purchasing real estate as an investment whether it be multi-family housing, single family housing, or even a mobile park. Real estate can take more capital to get into, but can be very lucrative over time. Funding private loans is an excellent way to get started in real estate investing.

ETF (exchange traded fund)

An investment that trades on an exchange, like a stock. Similar to a mutual fund, it holds underlying assets, however it can be traded throughout the day, not just at the end of the market hours. The fund provider owns the underlying assets and sells shares of that fund to you.

How to invest

There are many different online brokers you can use to invest such as Fidelity, Vanguard, TD Ameritrade, Webull, and many others to purchase stocks, bonds, ETF’s, and mutual funds.

There are also programs like Acorns who will round-up purchases and invest the spare change for you based on your risk portfolio.

Programs like Betterment are essentially a robo-advisor who will invest for you, which can be good for a beginning investor.

Before beginning to invest

How risk adverse are you? Can you handle watching your money decrease during a economic downturn? Are you holding for the long-term and okay with seeing a short-term decrease? Do you know how to analyze stocks or would you prefer to invest more safely with mutual funds and bonds? These are questions you must ask yourself before beginning your investment journey.

Figure out how much you can safely invest each month and stick to it. If you are unsure how much or what you should invest in, don’t hesitate to seek out an investment professional.